Context

In 2019 Jan Oberhauser launched N8N as a “Workflow automation alternative to Zapier” (see post on Hacker News).

Now, 6 years later they apparently managed to raise enough money to become a unicorn: As the german Handelsblatt writes (translated):

Valued at $2.4 billion, several people familiar with the negotiations told Handelsblatt. Start-ups with a valuation of more than $1 billion are considered unicorns. The financing round for n8n is expected to be completed shortly.

Back then, the space was full of competitors. As rrgggrr worte on the above-mentioned launch post:

Crowded space, but darn few (if any) shared source or community based solutions. Here's a several examples from a market study I did in 2018: Workato, Apiant, Inegromat, Snaplogic, CloudHQ, Boomi, Tibco, Jitterbit, AWS Lambda, Mulesoft, Tray.io, ApacheNiFi, Stringify, Adeptia, Kotive, Cazoomi, Scribesoft and several more.”

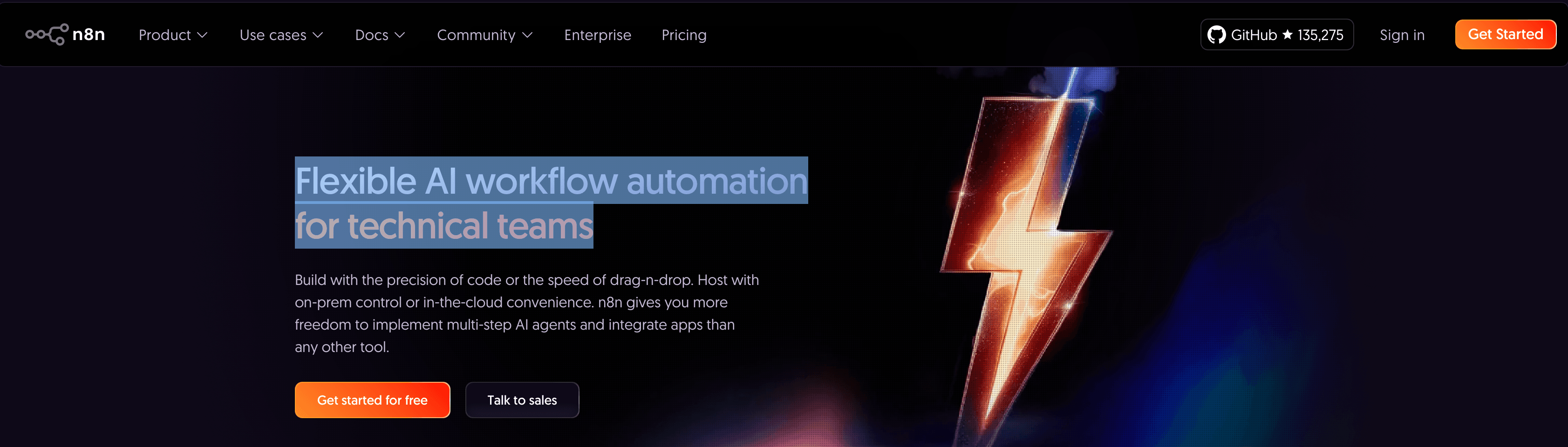

However, the space today is even more crowded and more faccetted:

- threat of disintermediation by native workflows. Companies like Notion are bundling workflow capabilities directly into their application

- a range of new agentic automation startups

- Zapier has not stopped innovating

- Big Tech solutions like Microsoft are coming up with Power Automate and Co.

Besides the competitive pressure, classical distribution channels are changing (think LLMs) and consumer preferences are changing. Because all of that affects us building Researchly, I dug deeper into (AI) automation tools to understand what that means for us (see end of post, the rest might be relevant to you, even if you are not working at Researchly)

N8N vs. Zapier or Zapier vs. N8N

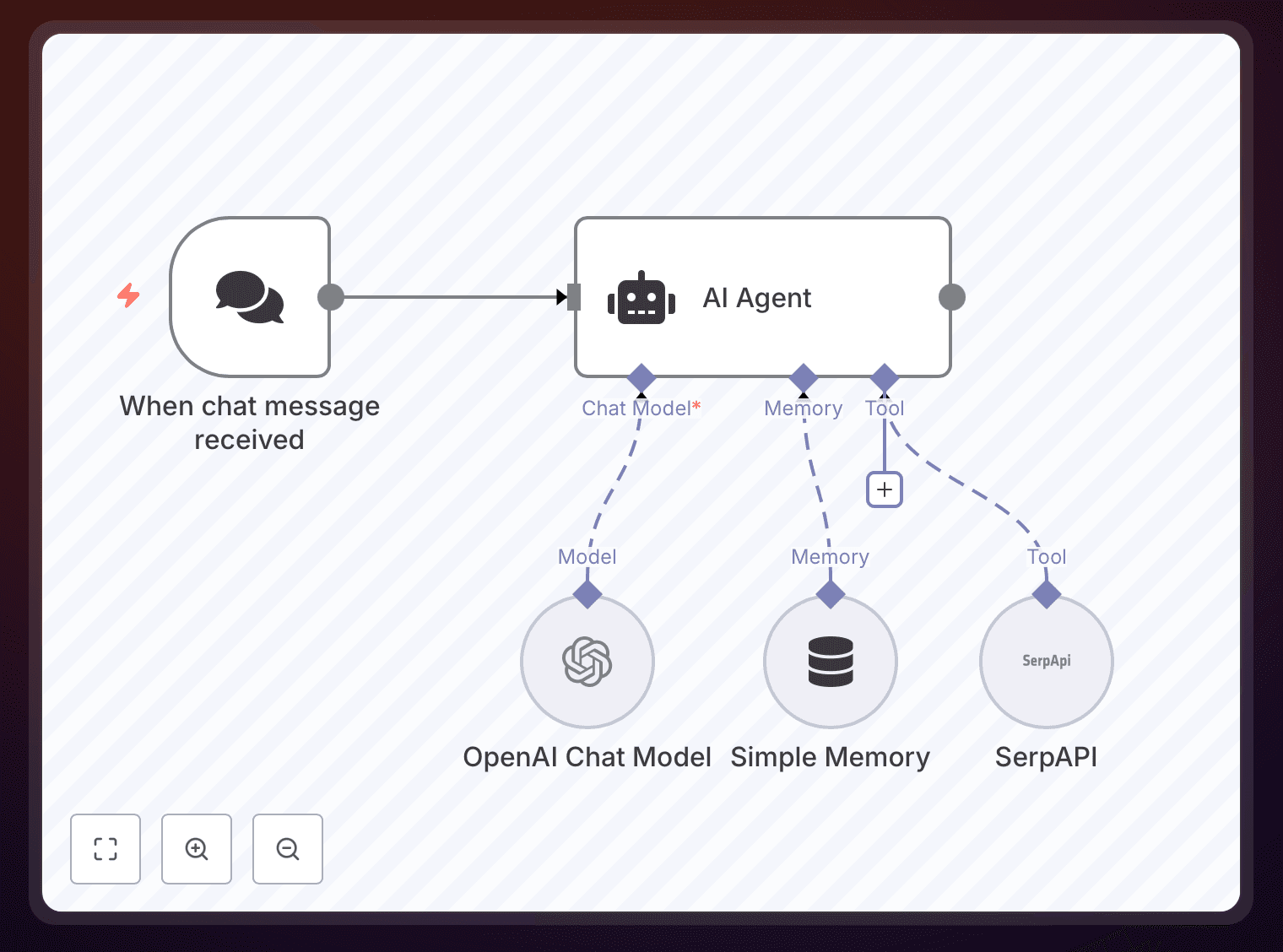

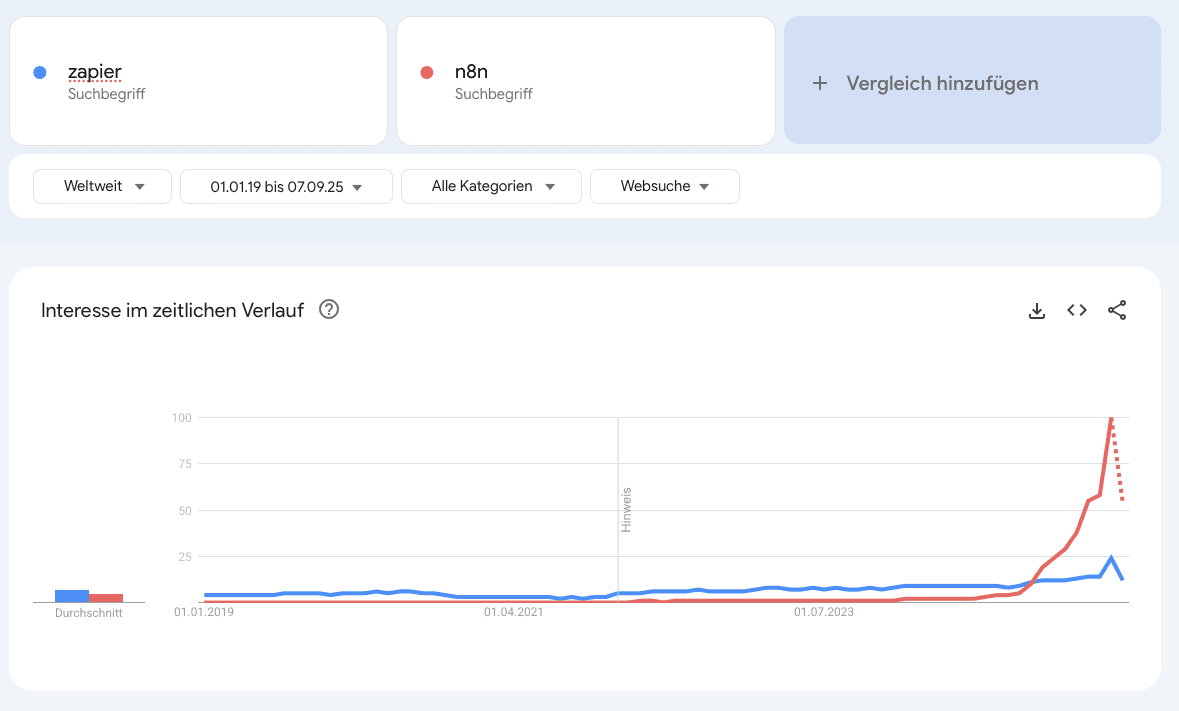

Historically, Zapier came before N8N and thus N8N established itself as David in the David vs. Goliath competition. However, if you look at the last six years, N8N grew, despite the strong competition - espeically in the last months. If you look at the Google Trends chart below, N8Ns growth basically exploded.

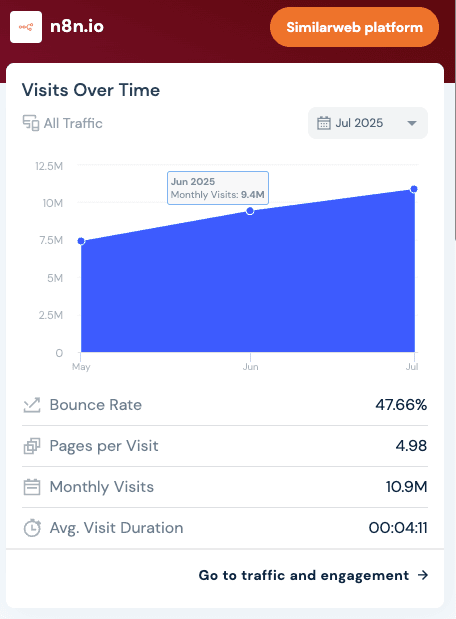

Furthermore, Zapier web traffic declined, while N8N’s grew. For that, take a look at the traffic data from Semrush:

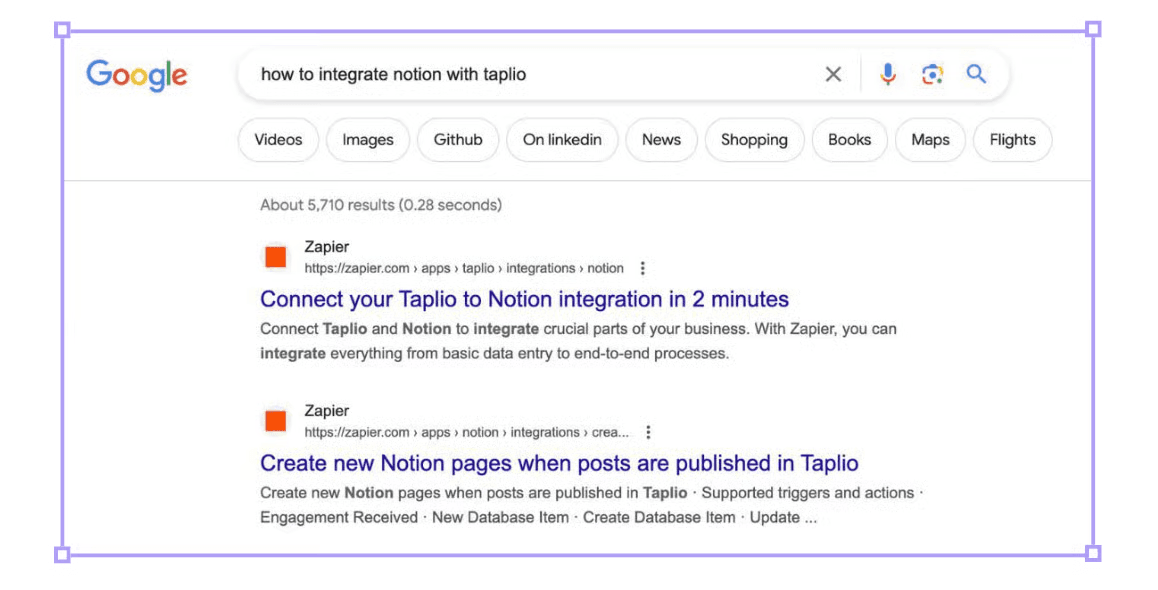

The decline in web traffic is interesting for a couple of reasons. Firstly, Zapier basically grew based on organic traffic. As Tom Alder writes on Strategy Breakdowns:

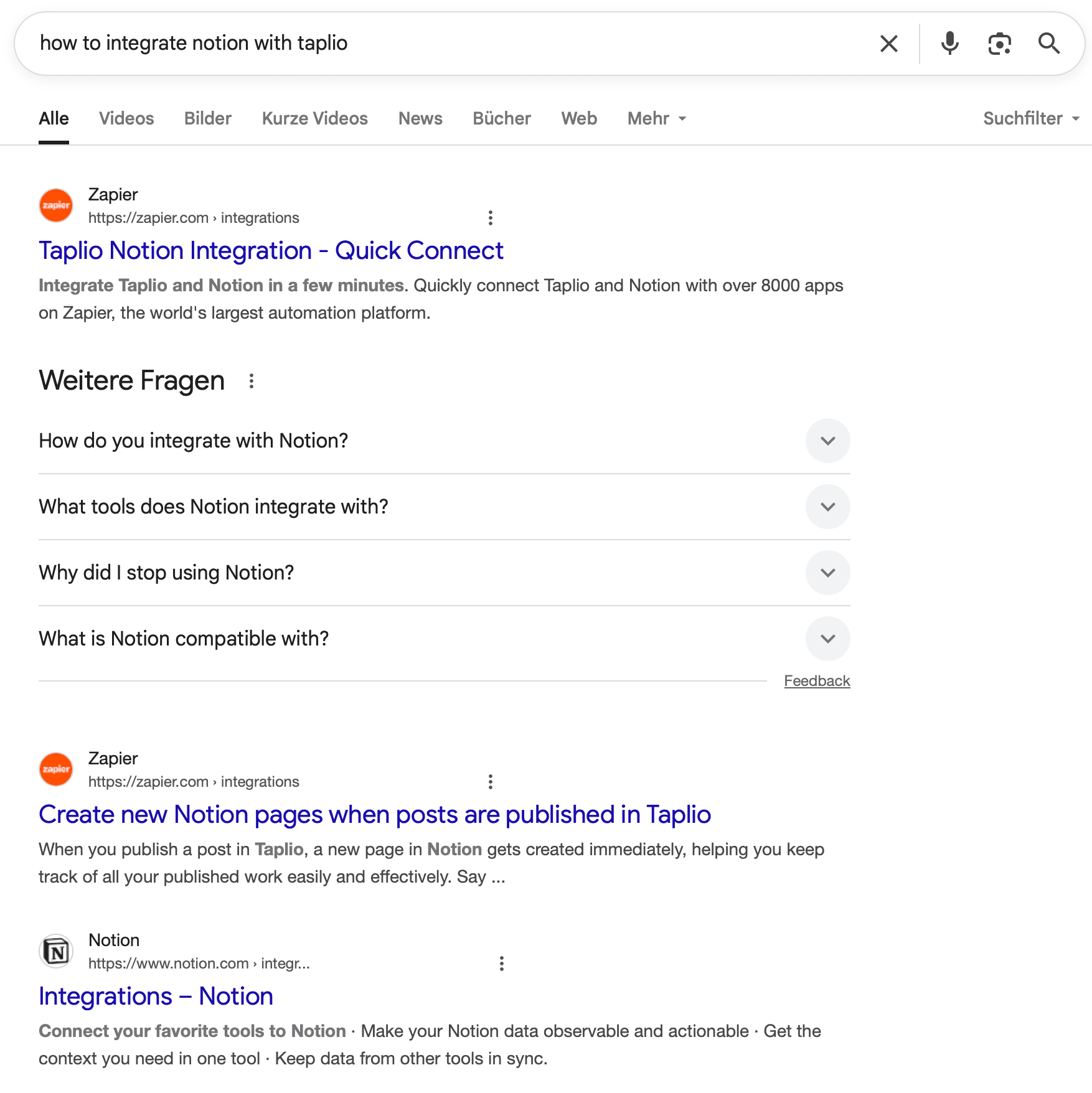

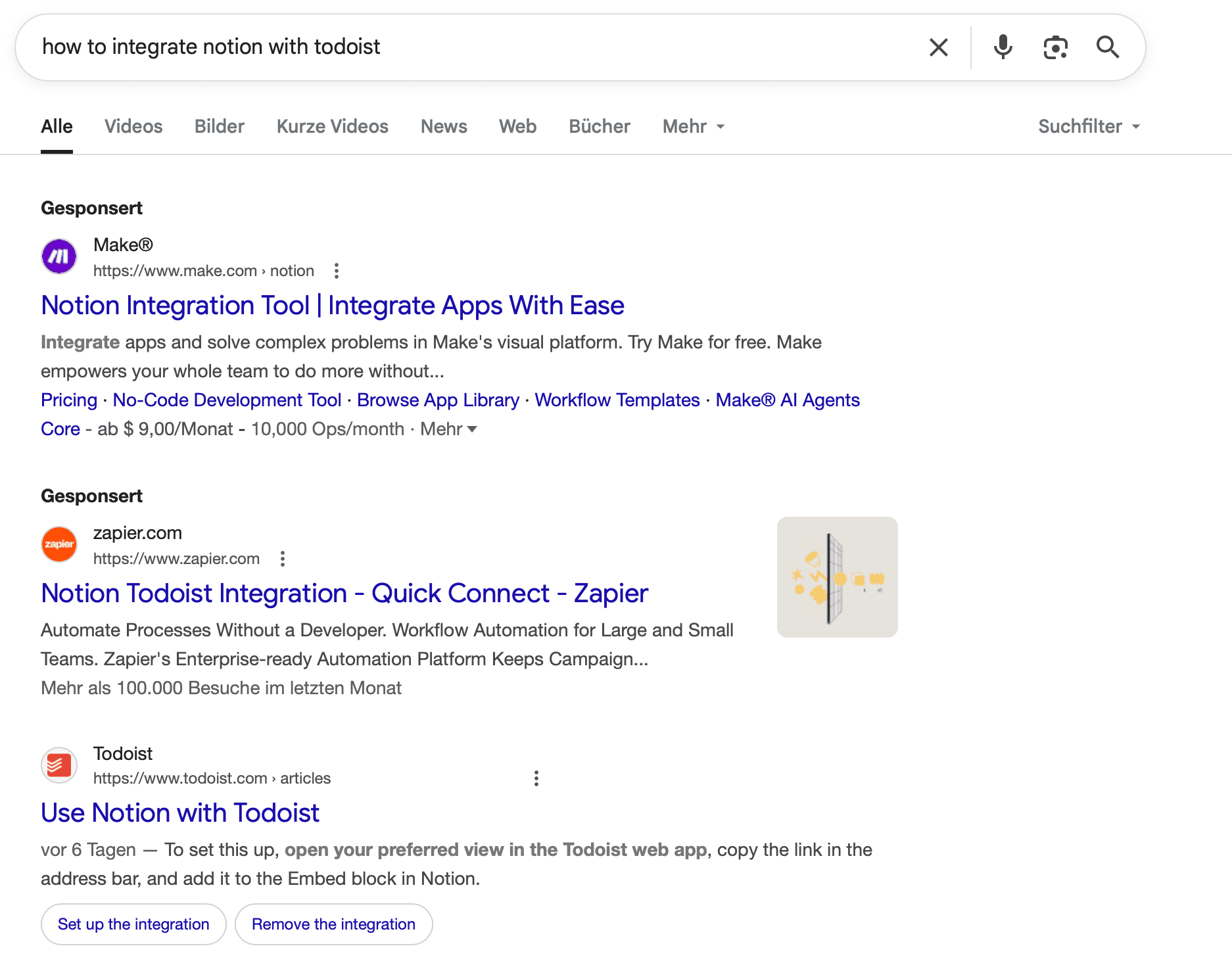

- A landing page for every use case Imagine you are a writer using Notion as a content calendar, and Taplio for LinkedIn scheduling. You want to automatically log published posts in a Notion database, to avoid manually copy-pasting each day. You search: “How to integrate Notion with Taplio” The top results - both Zapier. The 2nd link is exactly what you’re after. Click. You scan the page, sign up for free, and land directly in a ‘Zap’ configuration for your specific use case, bypassing any central dashboard or onboarding friction.

Secondly, the question is why their traffic is declining. This might be Google's fault.

Why is Zapier's web traffic declining: Google's AI Overview

As I have explained in SaaS Stocks and AI’s Disruption: Monday.com, Salesforce, Gartner & Beyond and Semrush: Alleged layoffs, and is AEO a feature or a company? SaaS startups are losing low-end consumers due to Google AI overview:

Here’s Monday.com — taken from their earnings calls transcript: Upmarket, we have record net adds for the 100,000 customers … we are seeing some softness within the down market due to the changes in the Google algorithm. But this is temporary, we believe, and we are already taking actions proactively to address this, and we believe this is going to be recovered going into the second half of the year.

So, the web traffic decline might be temporary and only to high-churning consumers with low CTV. However, if that is the case, two questions remain: Why didn't N8N traffic decline?